What is company car tax?

If you are provided a company car by your employer, in some instances they will allow you or your family to use your vehicle outside of work. Should you choose to take advantage of this, it is considered a perk of the job, as the car is provided by your employer and is treated as a Benefit-In-Kind (BIK). So, you will be required to pay tax on it.

How does company car tax work?

A company car is classed as a non-cash benefit to an employee, and like all BIK an individual will be required to pay tax on it if they are using the vehicle for personal/private usage. Company car tax is based on the taxable value of the benefit.

How much will I pay if I have a company car?

This will depend on a number of factors;

Vehicle List price including optional extras (P11D)

Vehicle emissions

Fuel it runs on (petrol/diesel/hybrid or full electric)

Your personal income tax rate (basic, higher or additional taxpayer)

How to work out the taxable value

There are two ways to work out the taxable value of your company car:

Using the HMRC Calculator

Follow this link to the HMRC Calculator.

You'll have to change some settings depending on the type of vehicle you have. You'll also have to input the CO2 emissions figure, which will be between 1-50g/km. If it's an electric vehicle, you'll need to fill in the section for 'zero emission mileage', which refers to how far an electric vehicle can travel solely on electric power before it needs to be recharged.

If you don't know your 'zero emission mileage' figure, then you can locate it on the vehicle's certificate of conformity (if it's registered to you) or from your leasing company provider if it's a lease - we'll be able to provide this to all of our customers.

Working out taxable value Manually

If for some reason the HMRC calculator doesn't work for you, there is a way to manually calculate the company car tax value using the P11D working sheet 2. An instance where you'll need to work it out this way is if the car was unavailable for at least 30 days (perhaps after an incident).

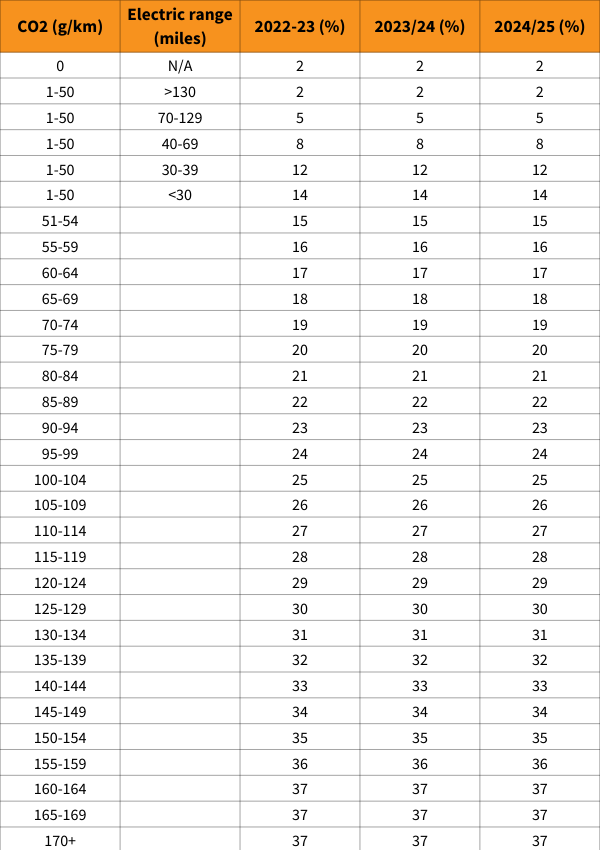

Company Car Tax Bands

This table shows future BIK tax bands (also known as company car tax) based on CO2 emissions of the vehicle. (Cars registered from 6 April 2020)

How to calculate company car tax

P11D Value x BiK CO2 Rate = BiK Value

Once you've got your BIK Value you can do the second part of the equation.

BiK Value x Tax Rate = Annual Company Car Tax

Electric Company Car Tax

As you'll see in the examples below, if you want to save big on your tax, then the best fuel type to go for is 100% electric because of its incredibly low tax based on low CO2 emissions.

Company car tax examples

Should I have a company car or do something else?

Usually an employer will not force you to have a company car. They will present you with a number of options so you can select the best fit for both your needs and the business. An alternate option could come in the shape of a car allowance.

Each case is different, so we can't give a one-size-fits-all recommendation as it will depend on your unique circumstances.

Should I have a petrol, diesel, hybrid or full electric company car?

If you're using it for a company car, then currently a full electric car would be the best option for your business. This is because the government is currently incentivising the adoption of electric vehicles so HRMC are currently applying very low tax to zero emission vehicles. In 2022/23 electric vehicles are taxed at only 2%.

If you can't stomach having a 100% electric vehicle, then a hybrid is the next most financially efficient company car for you to have, then diesel due to its high efficiency and finally petrol.

How to reduce a company car tax bill?

The best way to reduce and maintain a low company car tax bill is by choosing an electric vehicle.

What are the most expensive vehicles to tax

The most expensive vehicles to tax are those petrol vehicles with the highest list price, so think 5.0 litre Range Rovers or big inefficient diesel SUVs that carry the 4% surcharge.

What is the Diesel 4% supplement

For diesel cars, this percentage of BIK is increased by the diesel surcharge. The effect of the supplement is to impose a higher charge on a diesel car compared to a petrol car with the same CO2 emissions - this is to encourage people to go for powertrains that cause less pollution.

The diesel supplement is currently 4% as of 6 April 2018, at the same time an exemption was introduced for diesel cars which meet the new Real Driving Emissions 2 (RDE2) standard – also known as the Euro 6D standard. Those that meet that criteria do not incur the surcharge.

What about the tax on fuel?

Fuel is another benefit-in-kind (BIK) to you if your employer allows you to use the vehicle for your personal mileage. Check out our article on car tax fuel benefit to learn more and calculate your tax liability for it.

About The Author: Charlotte Kennedy

Charlotte joined the GB Vehicle Leasing team around 6 years ago starting out as an apprentice and is now being a key member of our marketing team.

Find Out More About CharlotteLatest Posts

Volkswagen Taigo vs T-Roc: How Do They Compare

Here, we explore how they compare...

Skoda Elroq Review 2025

Buckle up, folks! This new Skoda...

Pre-Registered Vehicles Explained

Learn what a pre-registered vehicle is...

Hyundai Inster Review 2025

Move over, conventional cars! The Hyundai...

Vehicle Delivery Lead Times Explained

From custom factory orders to in...