Car Fuel Benefit

What is a company car fuel benefit?

Employees who receive a company car, and are also given a fuel allowance that can be used for personal usage, are liable to pay company car fuel benefit tax. HMRC considers the company car fuel benefit to be free fuel to the employee and as such is a taxable benefit in kind (BIK). As that fuel is classed as a BIK, you are liable for tax on that fuel based on specific criteria for that benefit.

A real life example

This might happen when someone is given a fleet vehicle, like if they attend client meetings across the country, or someone who repairs items at client businesses will be given a fuel card to cover the cost of the fuel for that business travel.

If the company allows the individual to also use the fuel card to fill up the vehicle to be used for private usage, then the employee would be considered to be benefiting from the BIK of car fuel benefit.

How to calculate company car fuel benefit

Despite what many think, the individual doesn't pay tax on the specific amount of fuel, but rather the car and its emissions combined with your taxpayer rate.

In short, the company car fuel benefit tax is calculated as follows:

The vehicle CO2 emissions x fuel benefit charge x your personal income tax bracket

A bit more on that, you multiply the BIK tax rate of your vehicle by the current fixed sum set by HMRC, this usually changes every year. From April 2022 the car fuel benefit is £25,300.

You then need to identify the vehicle emissions, so you can work out what percentage of the £25,300 to give you your taxable amount. If your vehicle has a CO2 emissions g/km that fits between 90-94 bracket which is 23%. You will be eligible to pay tax on 23% of the £25,300 figure.

This equates to £5,819.

If you're a 20% income taxpayer then your tax liability on this benefit in kind would be 20% of the £5,819 meaning you have to pay £1163.8 for the year for the benefit or £96.9 per month.

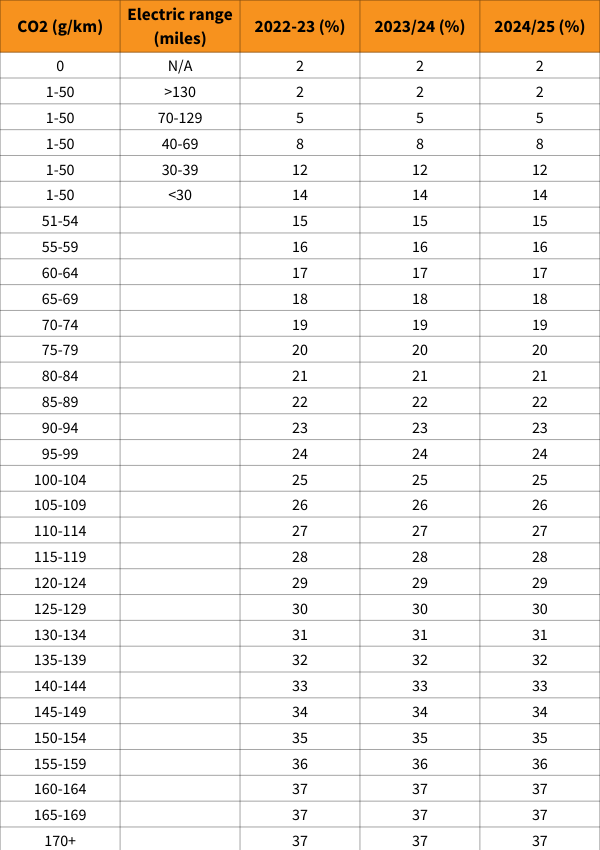

Benefit-in-Kind Rates

The table below displays BIK tax bands for 2022-2025 based on your vehicle's CO2 emissions. These BIK rates are for models registered from 6th April 2020 and applies to petrol, diesel (RDE2 standard), hybrid, and electric cars.

Is the company car fuel benefit worth it for you?

In some use cases, company car fuel benefit is great for the employee – but only if they complete extremely high mileage, where the cost of the free fuel would significantly outweigh the cost of paying tax on the benefit.

If you are the above example and your monthly fill ups cost less than the £96.90 per month, then it is more cost-effective for you to pay for your own fuel.

Each situation is different, so when you come to make a decision, figure out how many miles you'll be doing and the costs associated - especially if fuel is going to be more expensive, then work out what your tax liability would be.

Whatever is the lesser number, then that's the cheapest solution for you.

About The Author: Charlotte Kennedy

Charlotte joined the GB Vehicle Leasing team around 6 years ago starting out as an apprentice and is now being a key member of our marketing team.

Find Out More About CharlotteLatest Posts

Volkswagen Taigo vs T-Roc: How Do They Compare

Here, we explore how they compare...

Skoda Elroq Review 2025

Buckle up, folks! This new Skoda...

Pre-Registered Vehicles Explained

Learn what a pre-registered vehicle is...

Hyundai Inster Review 2025

Move over, conventional cars! The Hyundai...

Vehicle Delivery Lead Times Explained

From custom factory orders to in...